How to calculate Members Voluntary Liquidation Tax

10 likes | 15 Views

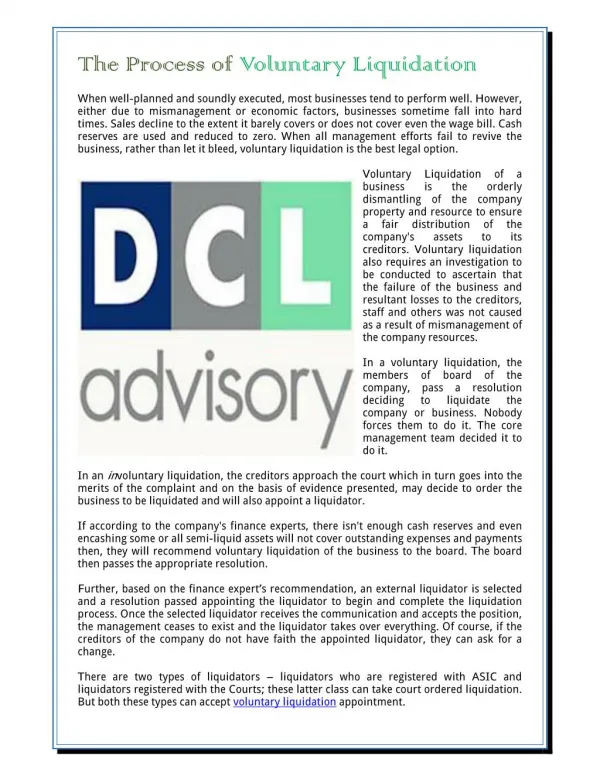

A memberu2019s voluntary liquidation is the formal process for closing down a solvent limited company. Your limited company is solvent if it has enough money to settle all its liabilities in full within 12 months. Liabilities include:<br>u2022tUnpaid bills<br>u2022tOutstanding subcontractorsu2019 invoices<br>u2022tAny loans youu2019ve taken, for example because youu2019ve bought equipment for the business<br>u2022tTax due to HMRC<br>u2022tAny future liabilities that havenu2019t crystallized yet<br>There are various reasons why youu2019d want to close down your limited company, even though itu2019s solvent. If youu2019ve decided to close your limited company, a m

Download Presentation

How to calculate Members Voluntary Liquidation Tax

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related