Aging Accounts Receivable

400 likes | 1.21k Views

Aging Accounts Receivable. Georgia CTAE Resource Network Instructional Resources Office Written by: Dr. Marilynn K. Skinner May 2009. To Receive Credit for this problem:.

Aging Accounts Receivable

E N D

Presentation Transcript

Aging Accounts Receivable Georgia CTAE Resource Network Instructional Resources Office Written by: Dr. Marilynn K. Skinner May 2009

To Receive Credit for this problem: Create a spreadsheet in Excel that will calculate the amounts for you. You may work with a partner, but you must turn in a printed copy of the spreadsheet and tell me whose folder it is saved under.

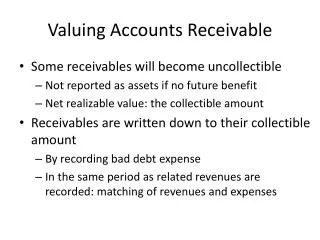

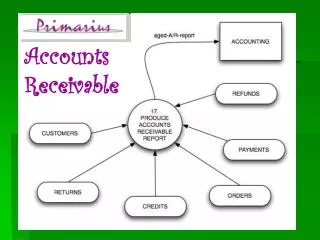

Why Age Accounts Receivable? • The longer it takes to collect an account the higher the chances that it will become uncollectible. • Companies can look back at past collections and predict a percentage of accounts that might not be paid.

Percentages Not Yet Due 2% 1-30 Days Past Due 4% 31-60 Days Past Due 25% 61-90 days Past Due 35% Over 90 Days Past Due 55%

Calculate Not Yet Due (2%) 562 X 2 % = 11.24

Calculate Not Yet Due (2%) 562 X 2 % = 11.24 Past Due : 1-30 Days (4%) 3,500 X 4%= 140.00

Calculate Not Yet Due (2%) 562 X 2 % = 11.24 Past Due : 1-30 Days (4%) 3,500 X 4%= 140.00 31-60 Days (25%) 1,902 X 25%= 475.50

Calculate Not Yet Due (2%) 562 X 2 % = 11.24 Past Due : 1-30 Days (4%) 3,500 X 4%= 140.00 31-60 Days (25%) 1,902 X 25%= 475.50 61-90 Days (35%) 120 X 35%= 42.00

Calculate Not Yet Due (2%) 562 X 2 % = 11.24 Past Due : 1-30 Days (4%) 3,500 X 4%= 140.00 31-60 Days (25%) 1,902 X 25%= 475.50 61-90 Days (35%) 120 X 35%= 42.00 90+ Days 1,071 X 55%= 589.05

Calculate Not Yet Due (2%) 562 X 2 % = 11.24 Past Due : 1-30 Days (4%) 3,500 X 4%= 140.00 31-60 Days (25%) 1,902 X 25%= 475.50 61-90 Days (35%) 120 X 35%= 42.00 90+ Days 1,071 X 55%= 589.05 Total 1,131.79

Allowance for Doubtful Accounts 354.00 ? 1131.79 Calculating Entry

Allowance for Doubtful Accounts 354.00 ? 1131.79 1131.79 – 354.00 = 777.79 Calculating Entry

Entry: Bad Debt Expense 777.79 Allowance for Doubtful Accounts 777.79